How can I track sales tax?

There are many legal limitations that need to be taken into consideration when adding and tracking sales tax. To begin to help you manage this in your Farmigo system, we have created a sales tax feature. Learn more about how this feature works by reading on below. If you are interested in having this feature turned on, please email support@farmigo.com.

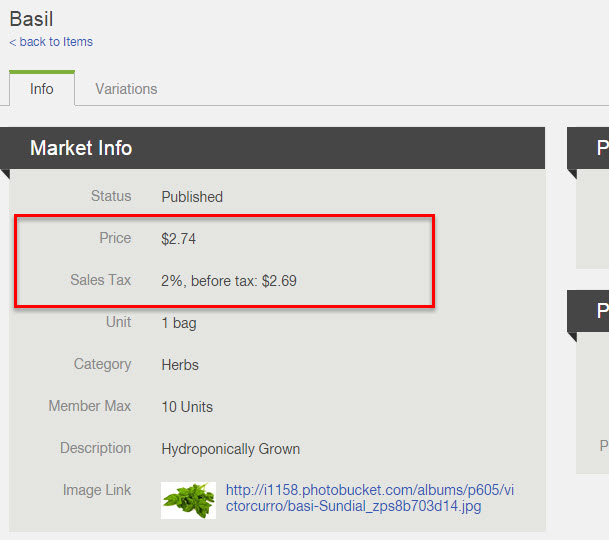

How to Add Sales Tax to a Share, Option or Item

|

To consider sales tax as part of the price of an item, you may take the following steps:

If you are interested in having this feature turned on, email support@farmigo.com. |

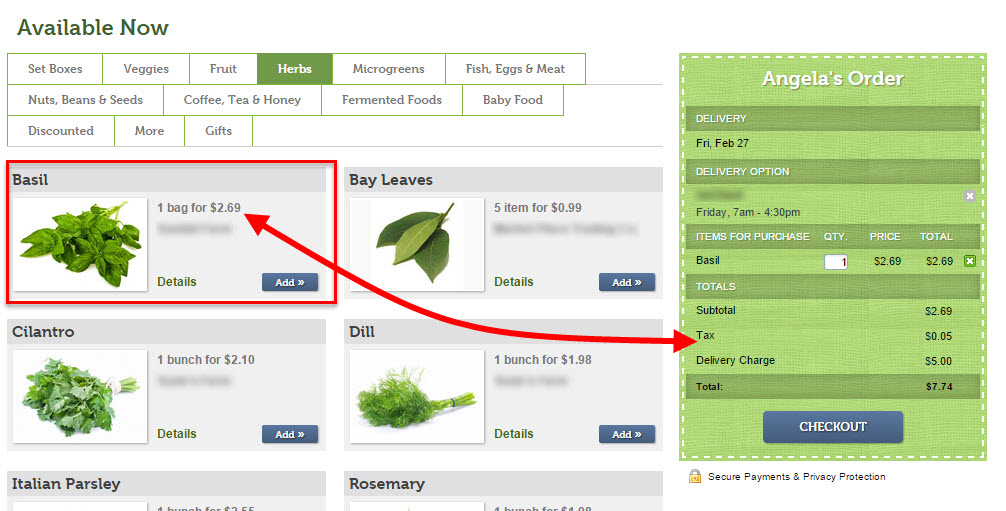

What Members See

When members select items from the join link or from the store link, they will see the before tax price listed for the item. Once the item item is selected, they will see the tax added in the order summary.

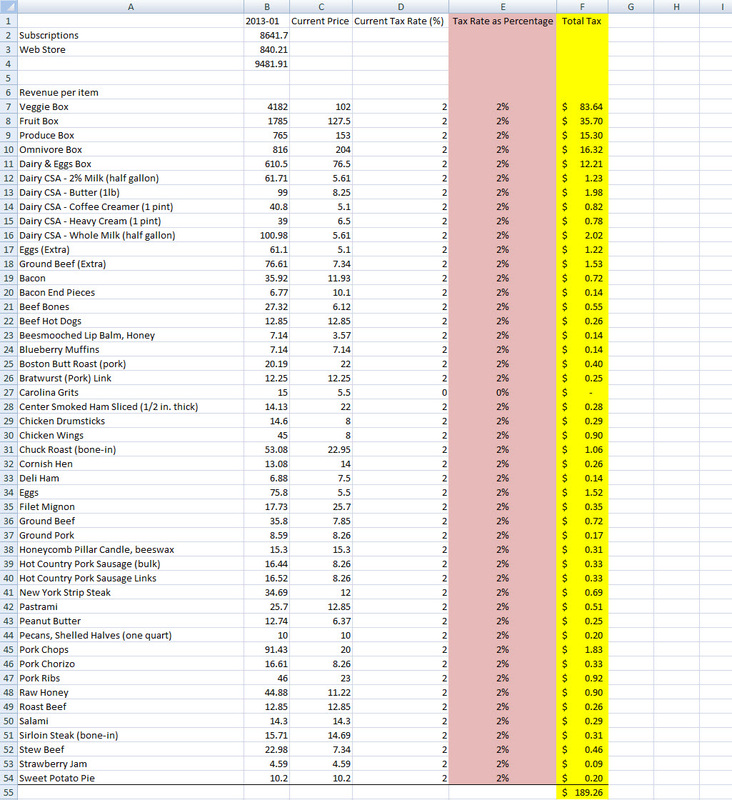

How to Track Sales Tax

You may calculate how much sales tax is owed for all items delivered during a specific time period by using the Past Deliveries ($) report where breakdown is by "Items". Once you have downloaded and opened the CSV file in a spreadsheet program, such MS Excel, take the following steps to determine the amount of sales tax owed:

- Add a column to the end at the right and enter a formula to convert the tax rate listed to a percentage, i.e. "=D7/100" (This is highlighted in pink below)

- Add another column to the end at the right and enter a formula to calculate sales tax based on total sales for that item, i.e. "=B7*E7" (This is highlighted in yellow below)

- Calculate the sum of column E.